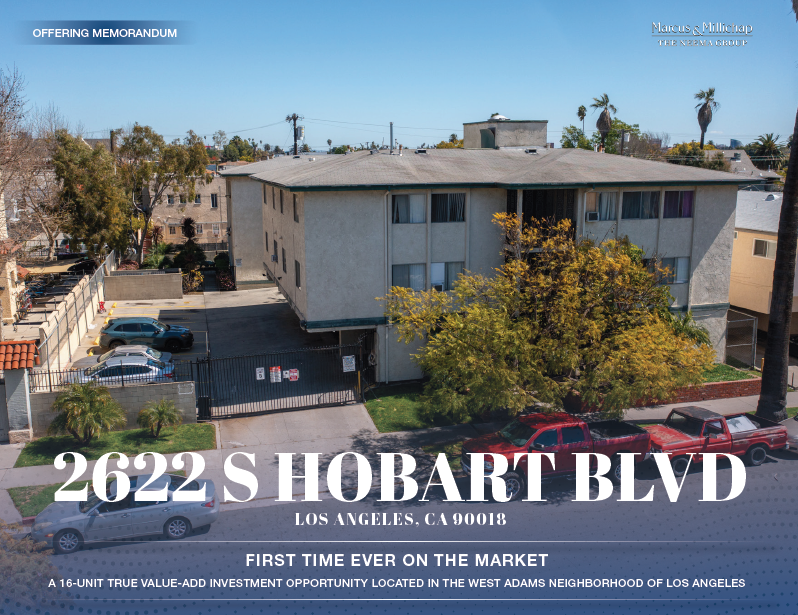

2622 S Hobart Blvd

Cette fonctionnalité n’est pas disponible pour le moment.

Nous sommes désolés, mais la fonctionnalité à laquelle vous essayez d’accéder n’est pas disponible actuellement. Nous sommes au courant du problème et notre équipe travaille activement pour le résoudre.

Veuillez vérifier de nouveau dans quelques minutes. Veuillez nous excuser pour ce désagrément.

– L’équipe LoopNet

merci

Votre e-mail a été envoyé !

2622 S Hobart Blvd Immeuble residentiel 16 lots 2 036 144 € (127 259 €/Lot) Taux de capitalisation 2,88 % Los Angeles, CA 90018

Certaines informations ont été traduites automatiquement.

INFORMATIONS PRINCIPALES SUR L'INVESTISSEMENT

- 2622 S Hobart Blvd is an ideal candidate for a Naturally Occurring Affordable Housing (NOAH) conversion

- Current 2-bedroom rents average ~$1,152, while market comparables exceed $2,200 — presenting over 88% rental upside

- Available as a portfolio with three other buildings, 2622 S Hobart Blvd offers true scale for operators seeking to grow within LA’s urban core

- 38% of tenants already on vouchers and the remaining rents are below 80% AMI

- Located on an expansive lot in addition to existing tuck under parking, significant ADU potential

RÉSUMÉ ANALYTIQUE

The Neema Group of Marcus & Millichap is pleased to present 2622 S Hobart Blvd, a 16-unit value-add investment opportunity in the rapidly evolving West Adams neighborhood of Los Angeles. Just south of W Adams Blvd, the property is situated minutes from Downtown Los Angeles and Koreatown, with convenient access to the 10 Freeway. The subject property was originally a HUD Project-Based Section 8 property and was opted out of the HUD program in September 2011.

The building features a well-balanced unit mix of six one-bedrooms and ten two-bedrooms, along with 16 parking spaces. With current rents significantly below market, the property offers an outstanding opportunity for investors to capitalize on over 88% rental upside.

The property is well positioned for a Naturally Occurring Affordable Housing (NOAH) conversion, as 38% of the current tenants are voucher holders, while the remaining units rent for below approximately 80% of the area’s median income (AMI). This favorable rent structure enhances the property’s long-term stability and appeals to both value-add and mission-driven affordable housing operators.

Ideally located less than a mile from the Metro Expo Line and steps from transit stops at W Adams Blvd and S Western Ave, 2622 S Hobart Blvd offers residents excellent connectivity to employment hubs and cultural districts. The property is also within walking distance of local retail, enhancing tenant appeal. Mid-City remains one of Los Angeles’ most densely populated and historically significant neighborhoods, with sustained demand for rental housing due to its proximity to major job centers and educational institutions. This investment presents a rare opportunity to acquire a well-located asset with significant value-add potential in one of the city’s most dynamic submarkets.

The building features a well-balanced unit mix of six one-bedrooms and ten two-bedrooms, along with 16 parking spaces. With current rents significantly below market, the property offers an outstanding opportunity for investors to capitalize on over 88% rental upside.

The property is well positioned for a Naturally Occurring Affordable Housing (NOAH) conversion, as 38% of the current tenants are voucher holders, while the remaining units rent for below approximately 80% of the area’s median income (AMI). This favorable rent structure enhances the property’s long-term stability and appeals to both value-add and mission-driven affordable housing operators.

Ideally located less than a mile from the Metro Expo Line and steps from transit stops at W Adams Blvd and S Western Ave, 2622 S Hobart Blvd offers residents excellent connectivity to employment hubs and cultural districts. The property is also within walking distance of local retail, enhancing tenant appeal. Mid-City remains one of Los Angeles’ most densely populated and historically significant neighborhoods, with sustained demand for rental housing due to its proximity to major job centers and educational institutions. This investment presents a rare opportunity to acquire a well-located asset with significant value-add potential in one of the city’s most dynamic submarkets.

BILAN FINANCIER (RÉEL - 2024) Cliquez ici pour accéder à |

ANNUEL | ANNUEL PAR m² |

|---|---|---|

| Revenu de location brut |

$99,999

|

$9.99

|

| Autres revenus |

$99,999

|

$9.99

|

| Perte due à la vacance |

$99,999

|

$9.99

|

| Revenu brut effectif |

$99,999

|

$9.99

|

| Taxes |

$99,999

|

$9.99

|

| Frais d’exploitation |

$99,999

|

$9.99

|

| Total des frais |

$99,999

|

$9.99

|

| Résultat net d’exploitation |

$99,999

|

$9.99

|

BILAN FINANCIER (RÉEL - 2024) Cliquez ici pour accéder à

| Revenu de location brut | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

| Autres revenus | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

| Perte due à la vacance | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

| Revenu brut effectif | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

| Taxes | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

| Frais d’exploitation | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

| Total des frais | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

| Résultat net d’exploitation | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

INFORMATIONS SUR L’IMMEUBLE

| Prix | 2 036 144 € | Sous-type de bien | Appartement |

| Prix par lot | 127 259 € | Classe d’immeuble | C |

| Type de vente | Investissement | Surface du lot | 0,12 ha |

| Taux de capitalisation | 2,88 % | Surface de l’immeuble | 1 329 m² |

| Multiplicateur du loyer brut | 10.9 | Occupation moyenne | 100% |

| Nb de lots | 16 | Nb d’étages | 3 |

| Type de bien | Immeuble residentiel | Année de construction | 1969 |

| Prix | 2 036 144 € |

| Prix par lot | 127 259 € |

| Type de vente | Investissement |

| Taux de capitalisation | 2,88 % |

| Multiplicateur du loyer brut | 10.9 |

| Nb de lots | 16 |

| Type de bien | Immeuble residentiel |

| Sous-type de bien | Appartement |

| Classe d’immeuble | C |

| Surface du lot | 0,12 ha |

| Surface de l’immeuble | 1 329 m² |

| Occupation moyenne | 100% |

| Nb d’étages | 3 |

| Année de construction | 1969 |

1 of 1

Walk Score®

Très praticable à pied (82)

TAXES FONCIÈRES

| Numéro de parcelle | 5053-012-034 | Évaluation totale | 247 026 € |

| Évaluation du terrain | 50 848 € | Impôts annuels | -1 € (0,00 €/m²) |

| Évaluation des aménagements | 196 178 € | Année d’imposition | 2024 |

TAXES FONCIÈRES

Numéro de parcelle

5053-012-034

Évaluation du terrain

50 848 €

Évaluation des aménagements

196 178 €

Évaluation totale

247 026 €

Impôts annuels

-1 € (0,00 €/m²)

Année d’imposition

2024

1 de 8

VIDÉOS

VISITE 3D

PHOTOS

STREET VIEW

RUE

CARTE

1 of 1

Présenté par

2622 S Hobart Blvd

Vous êtes déjà membre ? Connectez-vous

Hum, une erreur s’est produite lors de l’envoi de votre message. Veuillez réessayer.

Merci ! Votre message a été envoyé.