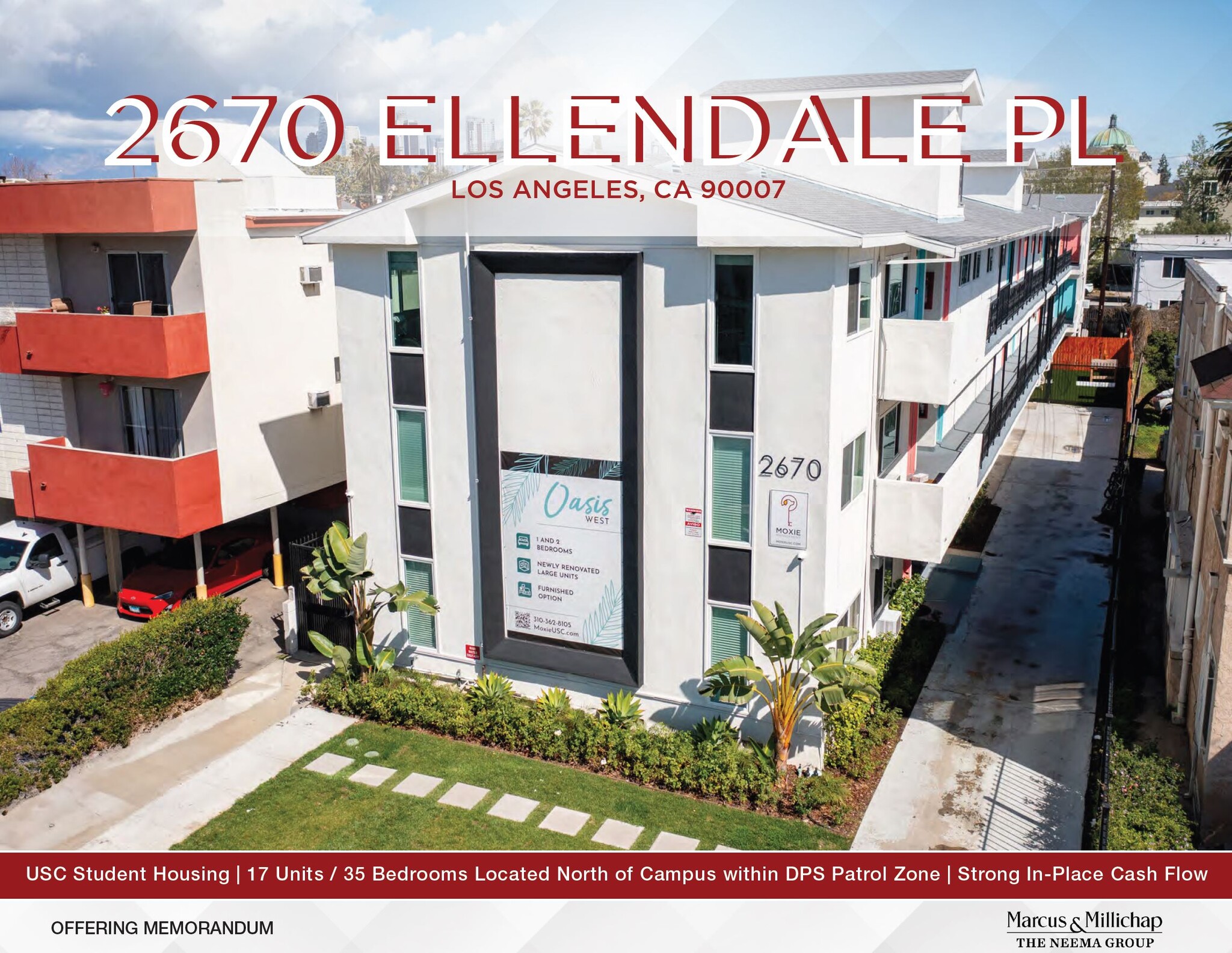

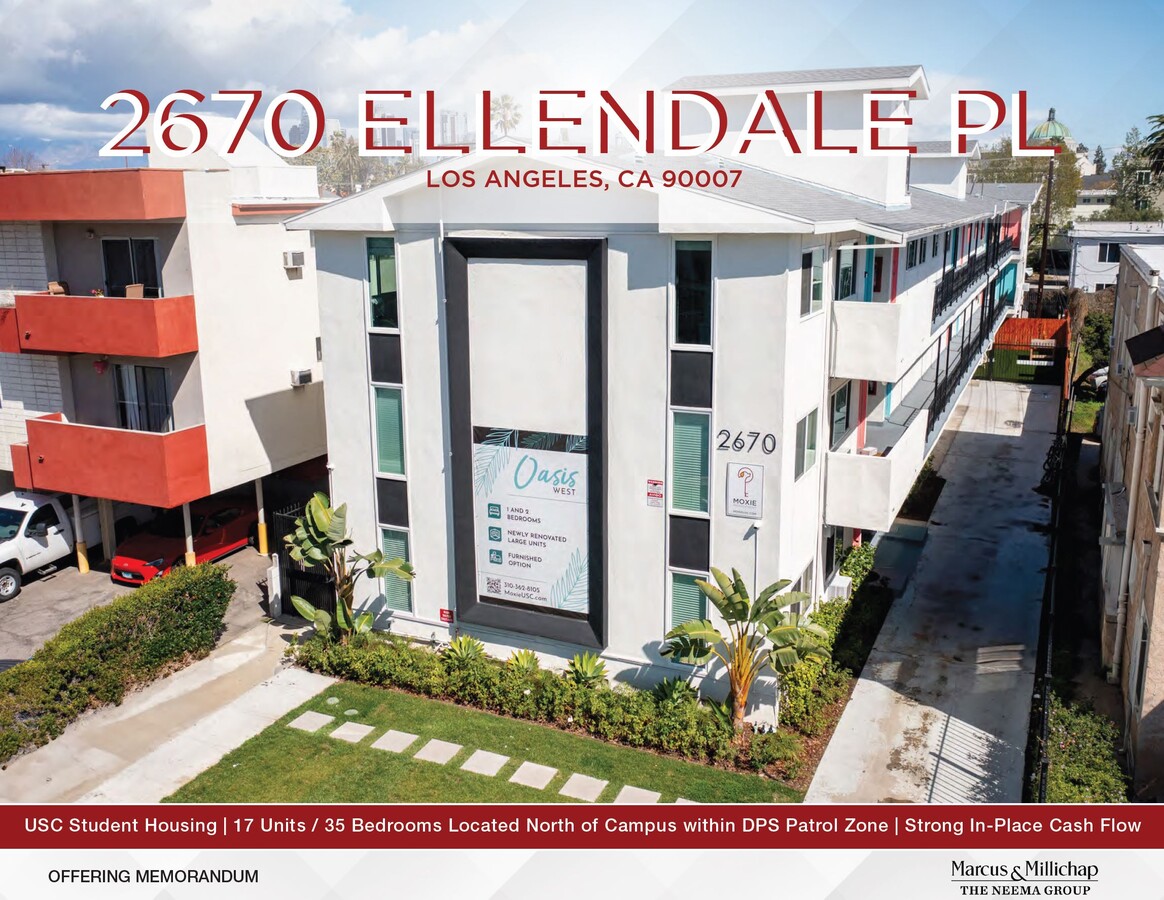

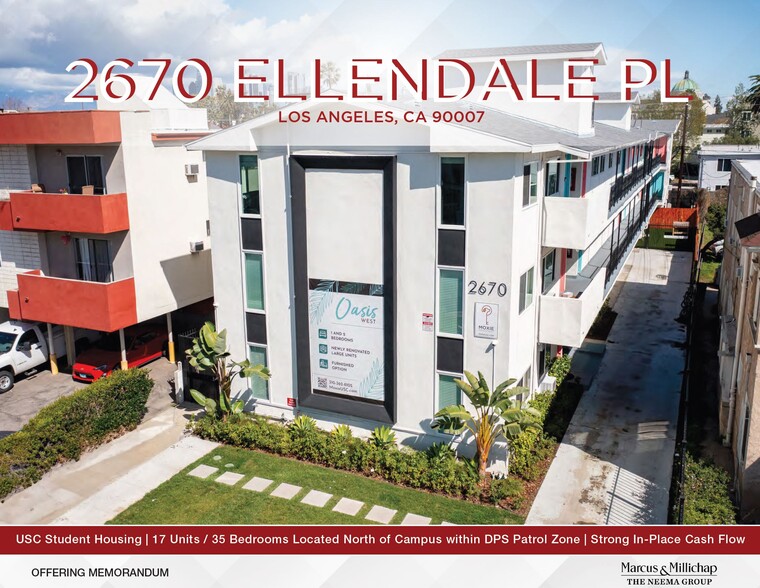

2670 Ellendale Pl

Cette fonctionnalité n’est pas disponible pour le moment.

Nous sommes désolés, mais la fonctionnalité à laquelle vous essayez d’accéder n’est pas disponible actuellement. Nous sommes au courant du problème et notre équipe travaille activement pour le résoudre.

Veuillez vérifier de nouveau dans quelques minutes. Veuillez nous excuser pour ce désagrément.

– L’équipe LoopNet

merci

Votre e-mail a été envoyé !

2670 Ellendale Pl Immeuble residentiel 17 lots 5 715 450 € (336 203 €/Lot) Taux de capitalisation 5,80 % Los Angeles, CA 90007

Certaines informations ont été traduites automatiquement.

INFORMATIONS PRINCIPALES SUR L'INVESTISSEMENT

- The Neema Group of Marcus & Millichap is pleased to present 2670 Ellendale Place, a newly renovated 17 Unit / 35 Bedroom student housing investment

- 13 of the 17 units are either brand new or fully renovated, presenting a prime opportunity to acquire a recession-proof passive investment

- The subject property is currently being rented by the unit and unfurnished, allowing further rental upside through double occupancy and furnished rent

- Located a half mile north of the University of Southern California, within the USC Department of Public Safety 24 Hour Patrol Zone

- The remaining 4 units have long term tenants at less than 30% of market rent, offering an investor significant upside potential

- The property is walking distance to the University Park Campus and USC Village

RÉSUMÉ ANALYTIQUE

The Neema Group of Marcus & Millichap is pleased to present 2670 Ellendale Place, a newly renovated 17 Unit / 35 Bedroom student housing investment opportunity located a half mile north of the University of Southern California, within the USC Department of Public Safety 24 Hour Patrol Zone.

The property is currently 100% occupied, driven by strong demand for off-campus housing from the 47,000 students currently enrolled at the University of Southern California. Approximately ~60% of all USC students live in off-campus housing, offering new ownership a low vacancy rate tied to one of the nation’s top academic institutions. USC continues to rise in academic rankings, setting a record high applications and record low acceptance rate in 2024.

13 of the 17 units are either brand new or fully renovated, presenting a prime opportunity to acquire a recession-proof passive investment, with minimal deferred maintenance and strong in-place cash flow. The remaining 4 units have long term tenants at less than 30% of market rent, offering an investor significant upside potential as these units turn.

The subject property is currently being rented by the unit and unfurnished, allowing further rental upside through double occupancy and furnished rentals. The units feature oversized living rooms and bedrooms, with similar 2-bedroom units achieving rents at $4,400 ($1,100 / bed). This significant rent discount to top of market rents offers a rare opportunity to own in a premier location with future rent runway.

The subject property has undergone an extensive CAPEX program, including a new roof, copper re-pipping of the building, replaced vertical waste lines, new main electrical panel, subpanels, and meters. The exterior of the building has also been painted, along with windows being replaced, throughout the property.

The property is walking distance to the University Park Campus and USC Village and presents a prime opportunity to acquire an existing cash flowing asset in the desirable North University Park submarket. This location has significant barriers to entry and is constrained by land-use regulations and continued community resistance to new construction, insulating the property from new rental competition.

The property is currently 100% occupied, driven by strong demand for off-campus housing from the 47,000 students currently enrolled at the University of Southern California. Approximately ~60% of all USC students live in off-campus housing, offering new ownership a low vacancy rate tied to one of the nation’s top academic institutions. USC continues to rise in academic rankings, setting a record high applications and record low acceptance rate in 2024.

13 of the 17 units are either brand new or fully renovated, presenting a prime opportunity to acquire a recession-proof passive investment, with minimal deferred maintenance and strong in-place cash flow. The remaining 4 units have long term tenants at less than 30% of market rent, offering an investor significant upside potential as these units turn.

The subject property is currently being rented by the unit and unfurnished, allowing further rental upside through double occupancy and furnished rentals. The units feature oversized living rooms and bedrooms, with similar 2-bedroom units achieving rents at $4,400 ($1,100 / bed). This significant rent discount to top of market rents offers a rare opportunity to own in a premier location with future rent runway.

The subject property has undergone an extensive CAPEX program, including a new roof, copper re-pipping of the building, replaced vertical waste lines, new main electrical panel, subpanels, and meters. The exterior of the building has also been painted, along with windows being replaced, throughout the property.

The property is walking distance to the University Park Campus and USC Village and presents a prime opportunity to acquire an existing cash flowing asset in the desirable North University Park submarket. This location has significant barriers to entry and is constrained by land-use regulations and continued community resistance to new construction, insulating the property from new rental competition.

BILAN FINANCIER (RÉEL - 2024) Cliquez ici pour accéder à |

ANNUEL | ANNUEL PAR m² |

|---|---|---|

| Revenu de location brut |

$99,999

|

$9.99

|

| Autres revenus |

$99,999

|

$9.99

|

| Perte due à la vacance |

$99,999

|

$9.99

|

| Revenu brut effectif |

$99,999

|

$9.99

|

| Taxes |

$99,999

|

$9.99

|

| Frais d’exploitation |

$99,999

|

$9.99

|

| Total des frais |

$99,999

|

$9.99

|

| Résultat net d’exploitation |

$99,999

|

$9.99

|

BILAN FINANCIER (RÉEL - 2024) Cliquez ici pour accéder à

| Revenu de location brut | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

| Autres revenus | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

| Perte due à la vacance | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

| Revenu brut effectif | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

| Taxes | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

| Frais d’exploitation | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

| Total des frais | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

| Résultat net d’exploitation | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

INFORMATIONS SUR L’IMMEUBLE

| Prix | 5 715 450 € | Style d’appartement | De faible hauteur |

| Prix par lot | 336 203 € | Classe d’immeuble | C |

| Type de vente | Investissement | Surface du lot | 0,1 ha |

| Taux de capitalisation | 5,80 % | Surface de l’immeuble | 1 356 m² |

| Multiplicateur du loyer brut | 11.32 | Occupation moyenne | 100% |

| Nb de lots | 17 | Nb d’étages | 3 |

| Type de bien | Immeuble residentiel | Année de construction/rénovation | 1964/2024 |

| Sous-type de bien | Dortoir | Zonage | LAR4 |

| Prix | 5 715 450 € |

| Prix par lot | 336 203 € |

| Type de vente | Investissement |

| Taux de capitalisation | 5,80 % |

| Multiplicateur du loyer brut | 11.32 |

| Nb de lots | 17 |

| Type de bien | Immeuble residentiel |

| Sous-type de bien | Dortoir |

| Style d’appartement | De faible hauteur |

| Classe d’immeuble | C |

| Surface du lot | 0,1 ha |

| Surface de l’immeuble | 1 356 m² |

| Occupation moyenne | 100% |

| Nb d’étages | 3 |

| Année de construction/rénovation | 1964/2024 |

| Zonage | LAR4 |

LOT INFORMATIONS SUR LA COMBINAISON

| DESCRIPTION | NB DE LOTS | MOY. LOYER/MOIS | m² |

|---|---|---|---|

| 1+1 | 2 | - | - |

| 2+1 | 12 | - | - |

| 2+2 | 2 | - | - |

| 5+5 | 1 | - | - |

1 of 1

Walk Score®

Très praticable à pied (87)

Bike Score®

Un paradis pour les cyclistes (91)

TAXES FONCIÈRES

| Numéro de parcelle | 5055-013-001 | Évaluation totale | 4 035 987 € |

| Évaluation du terrain | 2 825 191 € | Impôts annuels | -1 € (0,00 €/m²) |

| Évaluation des aménagements | 1 210 796 € | Année d’imposition | 2024 |

TAXES FONCIÈRES

Numéro de parcelle

5055-013-001

Évaluation du terrain

2 825 191 €

Évaluation des aménagements

1 210 796 €

Évaluation totale

4 035 987 €

Impôts annuels

-1 € (0,00 €/m²)

Année d’imposition

2024

1 de 13

VIDÉOS

VISITE 3D

PHOTOS

STREET VIEW

RUE

CARTE

1 of 1

Présenté par

2670 Ellendale Pl

Vous êtes déjà membre ? Connectez-vous

Hum, une erreur s’est produite lors de l’envoi de votre message. Veuillez réessayer.

Merci ! Votre message a été envoyé.