Dollar Store Portfolio | 9.0% CAP | Long

Cette fonctionnalité n’est pas disponible pour le moment.

Nous sommes désolés, mais la fonctionnalité à laquelle vous essayez d’accéder n’est pas disponible actuellement. Nous sommes au courant du problème et notre équipe travaille activement pour le résoudre.

Veuillez vérifier de nouveau dans quelques minutes. Veuillez nous excuser pour ce désagrément.

– L’équipe LoopNet

merci

Votre e-mail a été envoyé !

Dollar Store Portfolio | 9.0% CAP | Long Portefeuille de local commercial à vendre 6 biens 2 705 768 € Localisations multiples

Certaines informations ont été traduites automatiquement.

INFORMATIONS PRINCIPALES SUR L'INVESTISSEMENT

- DOLLAR GENERAL (NYSE: DG) | STRONG FINANCIAL COMPANY | MORE THAN 19,000 STORES ACROSS THE UNITED STATES

- RECENT LEASE EXTENSION | TENANT COMMITMENT TO LOCATION | DOUBLE NET (NN) LEASE INVESTMENT | LIMITED LANDLORD RESPONSIBILITIES

- CORPORATE GUARANTEE | INCREASING SALES & PROFIT YEAR • OVER YEAR | LEASE EXTENSION DEMONSTRATING TENANT’S COMMITMENT

- DOLLAR TREE & FAMILY DOLLAR (NYSE: DLTR) | STRONG FINANCIAL COMPANY | MORE THAN 15,000 STORES ACROSS THE UNITED STATES

- LOCAL MARKET REAL ESTATE ANSWERS CORPORATE SITE CRITERIA | DEMONSTRATES TENANT’S PROFITABILITY AT REGIONAL OR SMALL TOWN LOCATION | LOCATION CLASSIFIE

RÉSUMÉ ANALYTIQUE

DOLLAR GENERAL (NYSE: DG) | STRONG FINANCIAL COMPANY | MORE THAN 19,000 STORES ACROSS THE UNITED STATES

Dollar General has a total store count of 19,000+ stores operating across the US and has commitments to open more “new construction” stores as the company makes efficiency changes with increase of Distribution Centers and the Dollar General “Market” concept.

Corporate Guarantee | Dollar General (NYSE: DG) are publicly traded companies that have strong financial fundamentals that demonstrate a recession proof business model for being the “Walmart” to small towns in America.

Same Store Sales of the company has grown 4.3%+ year over year with a 10.6% increase in net sales, which demonstrates the Tenant’s commitment to store opening.

Dollar General will have continued profitability and efficiency throughout it’s system with increase in distribution centers, reducing freight container cost, and increases in product per ticket.

DOLLAR TREE & FAMILY DOLLAR (NYSE: DLTR) | STRONG FINANCIAL COMPANY | MORE THAN 15,000 STORES ACROSS THE UNITED STATES

Dollar Tree & Family Dollar now have a combined store count of 15,000+ stores operating across the US and has commitments to open more “new construction” stores as the company makes efficiency changes on poor performing stores.

Dollar Tree and Family Dollar (NYSE: DLTR) are publicly traded companies that have strong financial fundamentals that demonstrate a recession proof business model for being the “Walmart” to small towns in America.

Store closures of poor performing stores and expiring leases have led into a widening of profitability for the company combined with new stores which will fuel new store sales.

Profitability of the company has grown 20%+ year over year as the company makes efficiency changes throughout it’s Dollar Tree & Family Dollar brand combined with the reducing freight container cost and reinvestment into the business.

RECENT LEASE EXTENSION | TENANT COMMITMENT TO LOCATION | DOUBLE NET (NN) LEASE INVESTMENT | LIMITED LANDLORD RESPONSIBILITIES

Recent Lease Extension demonstrates Tenant’s commitment to the location.

Limited Landlord Responsibilities – Landlord to Pay Maintenance.

15+ Year Operating History in each location which demonstrates Tenant’s Commitment to the location.

Leases have been recently extended, which is another indicator of Tenant’s Commitment to the location.

Net Lease that provides as a hedge against inflation.

LOCAL MARKET REAL ESTATE ANSWERS CORPORATE SITE CRITERIA | DEMONSTRATES TENANT’S PROFITABILITY AT REGIONAL OR SMALL TOWN LOCATION | LOCATION CLASSIFIED AS WALMART OF SMALL TOWNS

Traffic counts of 5,000+ Cars per Day.

Regional or Small Town Demographics allow tenant market share control.

Local Schools & Employers allow for consistent day time and evening traffic which is another reason for Tenant’s Commitment to the location.

CORPORATE GUARANTEE | INCREASING SALES & PROFIT YEAR • OVER YEAR | LEASE EXTENSION DEMONSTRATING TENANT’S COMMITMENT

Lease is guaranteed by the corporate entity Dollar General (NYSE: DG) & Dollar Tree (NYSE: DLTR) accordingly. | Publicly traded backed lease allows for financial transparency along with enhanced credit for better lending options.

Strong Financials with year over year sales and profitability increases (***Ask Broker for Details).

Recent Lease Extension demonstrates Corporates commitment to the unit and location will continue to add value to the company’s profitability.

Dollar General has a total store count of 19,000+ stores operating across the US and has commitments to open more “new construction” stores as the company makes efficiency changes with increase of Distribution Centers and the Dollar General “Market” concept.

Corporate Guarantee | Dollar General (NYSE: DG) are publicly traded companies that have strong financial fundamentals that demonstrate a recession proof business model for being the “Walmart” to small towns in America.

Same Store Sales of the company has grown 4.3%+ year over year with a 10.6% increase in net sales, which demonstrates the Tenant’s commitment to store opening.

Dollar General will have continued profitability and efficiency throughout it’s system with increase in distribution centers, reducing freight container cost, and increases in product per ticket.

DOLLAR TREE & FAMILY DOLLAR (NYSE: DLTR) | STRONG FINANCIAL COMPANY | MORE THAN 15,000 STORES ACROSS THE UNITED STATES

Dollar Tree & Family Dollar now have a combined store count of 15,000+ stores operating across the US and has commitments to open more “new construction” stores as the company makes efficiency changes on poor performing stores.

Dollar Tree and Family Dollar (NYSE: DLTR) are publicly traded companies that have strong financial fundamentals that demonstrate a recession proof business model for being the “Walmart” to small towns in America.

Store closures of poor performing stores and expiring leases have led into a widening of profitability for the company combined with new stores which will fuel new store sales.

Profitability of the company has grown 20%+ year over year as the company makes efficiency changes throughout it’s Dollar Tree & Family Dollar brand combined with the reducing freight container cost and reinvestment into the business.

RECENT LEASE EXTENSION | TENANT COMMITMENT TO LOCATION | DOUBLE NET (NN) LEASE INVESTMENT | LIMITED LANDLORD RESPONSIBILITIES

Recent Lease Extension demonstrates Tenant’s commitment to the location.

Limited Landlord Responsibilities – Landlord to Pay Maintenance.

15+ Year Operating History in each location which demonstrates Tenant’s Commitment to the location.

Leases have been recently extended, which is another indicator of Tenant’s Commitment to the location.

Net Lease that provides as a hedge against inflation.

LOCAL MARKET REAL ESTATE ANSWERS CORPORATE SITE CRITERIA | DEMONSTRATES TENANT’S PROFITABILITY AT REGIONAL OR SMALL TOWN LOCATION | LOCATION CLASSIFIED AS WALMART OF SMALL TOWNS

Traffic counts of 5,000+ Cars per Day.

Regional or Small Town Demographics allow tenant market share control.

Local Schools & Employers allow for consistent day time and evening traffic which is another reason for Tenant’s Commitment to the location.

CORPORATE GUARANTEE | INCREASING SALES & PROFIT YEAR • OVER YEAR | LEASE EXTENSION DEMONSTRATING TENANT’S COMMITMENT

Lease is guaranteed by the corporate entity Dollar General (NYSE: DG) & Dollar Tree (NYSE: DLTR) accordingly. | Publicly traded backed lease allows for financial transparency along with enhanced credit for better lending options.

Strong Financials with year over year sales and profitability increases (***Ask Broker for Details).

Recent Lease Extension demonstrates Corporates commitment to the unit and location will continue to add value to the company’s profitability.

INFORMATIONS SUR L’IMMEUBLE

| Prix | 2 705 768 € | Statut | Actif |

| Prix/m² | 549,06 € / m² | Nb de biens | 6 |

| Condition de vente | Cession-bail | Individuellement en vente | 0 |

| Taux de capitalisation | 9,07 % | Surface totale de l’immeuble | 4 928 m² |

| Type de vente | Investissement triple net | Surface totale du terrain | 2,09 ha |

| Prix | 2 705 768 € |

| Prix/m² | 549,06 € / m² |

| Condition de vente | Cession-bail |

| Taux de capitalisation | 9,07 % |

| Type de vente | Investissement triple net |

| Statut | Actif |

| Nb de biens | 6 |

| Individuellement en vente | 0 |

| Surface totale de l’immeuble | 4 928 m² |

| Surface totale du terrain | 2,09 ha |

Biens

| NOM DU BIEN/ADRESSE | TYPE DE BIEN | SURFACE | ANNÉE DE CONSTRUCTION | PRIX INDIVIDUEL |

|---|---|---|---|---|

|

Dollar General

225 Church St, Andalusia, AL 36420 |

Local commercial | 844 m² | 1984 | - |

|

Dollar General

7006 Cumberland Gap Pky, Harrogate, TN 37752 |

Local commercial | 855 m² | 1996 | - |

|

Dollar Tree

721 S Main St, Monmouth, IL 61462 |

Local commercial | 722 m² | 2002 | - |

|

Dollar General

505 S Commercial Dr, Abingdon, IL 61410 |

Local commercial | 755 m² | 2003 | - |

|

Dollar General

500 E Saint Joseph St, Springfield, IL 62703 |

Local commercial | 775 m² | 2019 | - |

|

Dollar General

425 Hunt St, Leadwood, MO 63653 |

Local commercial | 977 m² | 1950 | - |

1 of 1

1 de 11

VIDÉOS

VISITE 3D

PHOTOS

STREET VIEW

RUE

CARTE

1 of 1

Présenté par

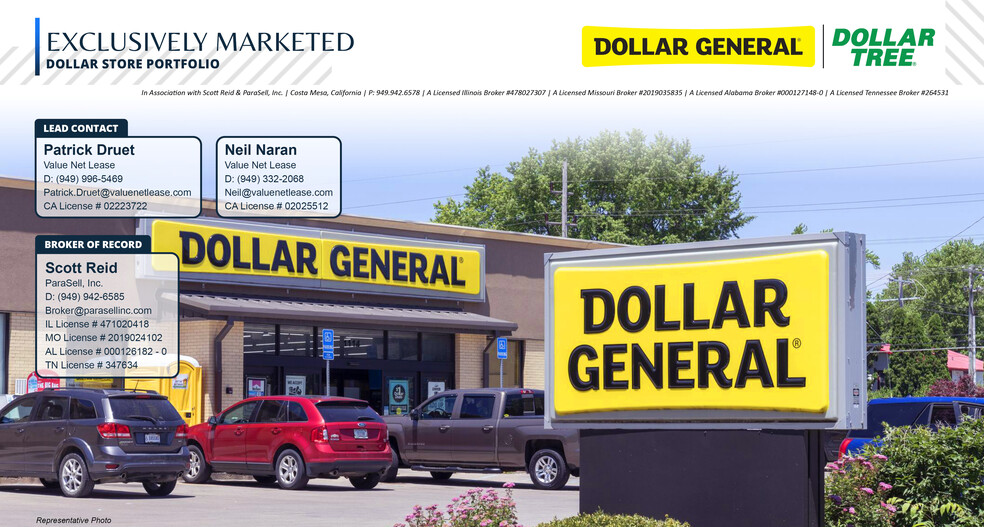

Value Net Lease Partners

Dollar Store Portfolio | 9.0% CAP | Long

Vous êtes déjà membre ? Connectez-vous

Hum, une erreur s’est produite lors de l’envoi de votre message. Veuillez réessayer.

Merci ! Votre message a été envoyé.